Feb 24, 2022

The border standoff between Russia and Ukraine has become increasingly tense in recent days. Russian President Vladimir Putin Thursday recognized the independence of the Donetsk People's Republic and The Luhansk People's Republic and signed relevant agreements, CCTV reported.

The Russian stock market fell sharply that day. Russia's MOEX index fell more than 15% at one point, and the RTS index fell more than 17%. By the close, the RTS index was down 13.21 percent.

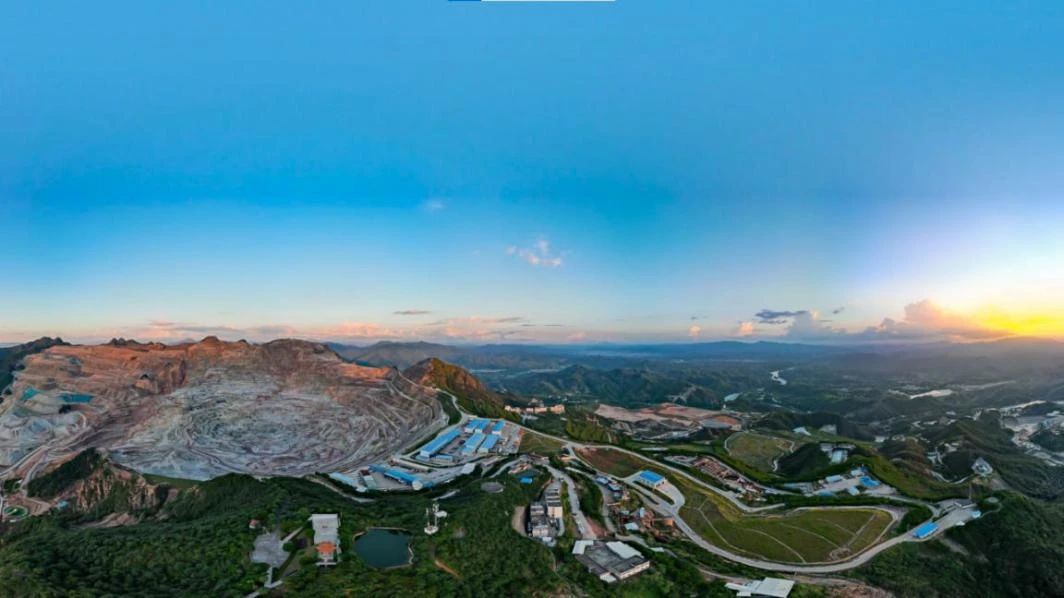

A conflict between Russia and Ukraine, both rich in mineral resources, could have implications for international markets, with reports of rising tensions driving nickel prices to their highest levels in more than a decade on concerns about supply. So what else does the situation have to do with the mining market?

According to SMM data, on February 22, Lun Aluminum hit a 13-year high of $3,342 / ton, Shanghai aluminum main contract once again stood at 23,000 yuan/ton. Spot aluminum prices also rose, SMMA00 aluminum quoted at 22,930 yuan/ton, up 330 yuan/ton from the previous day. In terms of zinc, zinc prices rebounded slightly in Shanghai market on February 22, with the average price of SMM 0# zinc ingot reaching 24890 yuan/ton. In copper, electrolytic copper prices fell slightly, averaging 71,180 yuan/ton.

A number of industry insiders said the russia-Ukraine situation on aluminum, zinc, copper and other non-ferrous metal market is more indirect impact through energy.

Chen Sijie, an analyst at Huatai Futures, said the impact of the russia-Ukraine conflict is more based on the impact of energy shortages on production cuts, which will not only affect Russia's domestic production capacity, but also the production of a large number of non-ferrous metals in Europe.

As tensions rise between Russia and Ukraine, smelters in Europe will be hit by higher gas prices and higher electricity costs. In terms of zinc, data show that Zinc smelters in Europe have a capacity of 2.3 million tons. If the situation between Russia and Ukraine is further fermented, it will have an impact on zinc supply.

至于铝,陈sijie指出,俄铝is one of the largest aluminum producers in the world, with a capacity of more than 4 million tons of electrolytic aluminum, accounting for more than 6% of the global electrolytic aluminum capacity. In 2018, the U.S. government imposed sanctions on Russian aluminum, which caused international aluminum prices to surge more than 30% in 11 trading days and disrupted the global aluminum supply chain. The recent escalation of the Conflict between Russia and Ukraine could lead to a repeat of the situation in 2018 if there is a military conflict between Russia and Ukraine and the US increases sanctions. At the same time, from the second half of 2021, due to political tensions between Europe and Russia, natural gas supply shortages and energy prices have repeatedly soared, aluminum smelters have cut production, affecting about 850,000 tons of electrolytic aluminum capacity, accounting for 1.1% of global capacity. If the conflict between Russia and Ukraine becomes more intense, Europe's electrolytic aluminum production capacity may be further affected.

Copper market, Soochow futures analysts said that Russia is the world's fourth largest producer of refined copper, refined copper supply in recent years stable at 1 million tons, the world accounted for about 4%, if western countries on Russia sanctions, Russia refined copper exports may be blocked. However, analysts at Huatai Futures pointed out that China imports copper concentrate mainly from South America and imports from Russia are very limited, so the impact of Russian copper supply on China's imports is limited.